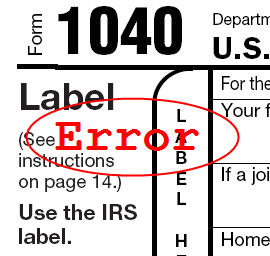

It is almost a certainty that tax rates across the board will begin increasing come January 1, 2011. Ordinary income tax rates will increase 3-5% for those in the 31% to 39% tax bracket, the dividend tax could jump from 15% to 39.6%, & long-term capital gains tax could go from 15% to 20% or even higher. As we head closer to January 1st, it is becoming more and more important to start accelerating income and deferring deductions. Read More.