Should I Use a Debt Settlement Company Now?

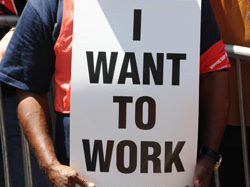

There’s no question that unemployment can put a strain on marriage. Often times, the marriage becomes tenuous when spouses don’t honestly communicate with each other how they are going to handle the situation. One spouse looking at classified job ads & the other being upset about the whole situation and just trying to work overtime to make up for the lost income, usually doesn’t work. Read More.

Many homeowners these days are confronted with the big question – do I refinance now since rates are at all-time lows or hold off? While rates are low, the answer to this question really depends on the specific financial position of the mortgage holder as our financial experts explain. Read More.

Should My Child Be an Authorized User on My Credit Card Account?

Many parents don’t realize the benefits that come along with adding their child to their credit card account as an authorized user. Instead, they are focusing more on the risk that their child may not be financial responsible enough to have that privilege. But, if you are not worried about your child running up your credit card bill, sign them up as an authorized user which will better prepare them for the future. Read More.

Improving Your Family Financial Budget

Getting Accurate Mortgage Closing Cost Estimates

How To Cut Down On Expenses During Retirement

You finally reached retirement & now are faced with managing your finances after experiencing the worst financial crisis in decades. In addition, the financial planning you did 5 to 10 years ago no longer makes sense since today the average 65 year old can expect to live to almost 84 vs. a life expectancy of 77.9 in 2007 (CDC Aug ‘09). Suddenly, you are forced to make significant lifestyle changes to support yourself & family well into the future. And, for those that aren’t at retirement yet, you’re not off the hook. The 65 year old plus population is expected to grow from 40M today to 71M or 20% of the population in 2030 (US Census Bureau June ‘09). In essence, this means that on average you are going to be living much past 84. So with all of this data, what can we do to live the retirement life we once envisioned? It starts with cutting out expenses.

Read More.

Should I Close My Credit Card Account?

Let’s get one thing straight. Closing a credit card account DOES hurt your credit score (i.e. FICO Score). Now, the degree that your credit score may be impacted depends on several factors which we will discuss below. Read More.

Does this sound familiar? You go home after a long day of work only to be bombarded by overdraft protection notices in the mail indicating that you need to “opt-in” or out of the program by August 15th. That’s convenient. The last thing you want to do is read some financial agreement in fine print with confusing terms. Depending on your state of mind at the time, you may even accept the banks offer since the marketing language in the agreement may make it seem as though it is the right thing to do. With that said, let’s put the overdraft protection program in more digestive terms so we can all understand exactly what opting-in means. Read More.