Trusted Answers From Licensed Business Professionals

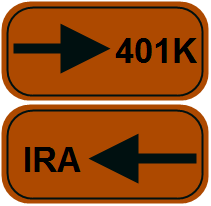

Should I Still Contribute To My 401K When I’m Older?

By The BIDaWIZ Team on October 19th, 2012 at 6:30 pm

How Much Can I Contribute to My 401K and IRA in 2013?

By The BIDaWIZ Team on October 19th, 2012 at 4:00 pm

Is There A Way To Avoid IRA Required Minimum Distributions?

By The BIDaWIZ Team on October 18th, 2012 at 7:00 pm

Factors To Consider When Choosing a Credit Card Processor

By The BIDaWIZ Team on October 17th, 2012 at 5:00 pm

Should I Sell My Car to Payoff Credit Card Debt And Lease One Instead?

By The BIDaWIZ Team on October 12th, 2012 at 6:30 pm

Do You Know What the Fees Are For Your 401(K) Plan Now?

By The BIDaWIZ Team on October 11th, 2012 at 8:00 pm

Back in May, we noted that the new 401(k) disclosure rules would be in effect by the end of the summer. The intent of these rules was to provide greater transparency to both employers and employees. Did it work and have you noticed a difference in the reporting? Read More.

Should You Consider Revenue-Based Financing For Your Business?

By The BIDaWIZ Team on October 4th, 2012 at 5:30 pm

Is There A Deduction For Burning Down A House?

By The BIDaWIZ Team on October 4th, 2012 at 3:00 pm

With the housing market showing some signs of life, the times of purchasing properties to knock down a home and build a new one, may be returning. Getting rid of the home can actually be a costly process as it requires a demolition team and removal. To reduce the cost and apply for a tax break at the same time, some have let their local fire department handle the demolition and treated it as a charitable gift at the same time. Read More.

Are You Putting Any Nontraded Assets into Your IRA or Roth?

By The BIDaWIZ Team on October 3rd, 2012 at 6:00 pm

What Expenses Can I Deduct For My Home Based Business?

By The BIDaWIZ Team on October 2nd, 2012 at 8:00 pm