What Forms Do I Need To File To Hire Employees?

Accounting Today Covers Our Survey: Tax Pro Versus DIY Software

Tips For Forming a Board of Directors For Your Business

The Importance Of Understanding IRA Rollover Rules

Are You Planning To Acquire A Small Business?

Do You Have The Best 401K For Your Employees?

Retirement accounts are typically your employees’ most valuable financial asset, with the exception of their homes. Yet, employers don’t always select a 401(k) plan that provides the most value and has the lowest fees. The consequences can be devastating to your employees’ retirement accounts. Read More.

Are You Getting Enough Value From Your Accountant?

When most of us think about our accountant, filing taxes often comes to mind. However, accountants are trusted advisors that can offer much more to their clients than just preparing tax returns. Recently, we had a chance to speak with Greg Freyman to learn more about his New York City based accounting practice and the ways he is able to offer value to his clients. Read More.

Is Your Business At Risk For A Sales Tax Audit?

Nearly half of state revenue is generated from sales tax sources. Specifically, general sales tax accounts for 30.1% of total state tax revenue and selective sales tax (liquor, fuel, tobacco) totaled 16.3% in 2013. As such, state regulators try to collect every dollar that is owed to them. This may mean that your business could be at risk should you not have the appropriate reporting processes in place to ensure sales tax compliance with the authorities. Fortunately, we recently had the opportunity to speak with Brandon Houk to learn more about how Avalara can help businesses with sales tax compliance. Read More.

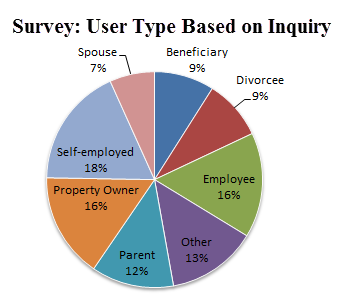

Are Filers Satisfied With DIY Software or Their Tax Pro?

What The New Mortgage Environment Means For You

Last summer’s rise in mortgage rates has begun to impact the lending environment. The major bellwether mortgage lenders (J.P. Morgan & Wells Fargo) reported 28% declines in mortgage origination in the first quarter of 2014 as compared to the prior quarter. Moreover, the lending market at a whole is down 58% year over year. Read More.