Sales tax remains an attractive component for generating state revenue. In fact, nearly half of state revenue is derived from sales tax sources. Specifically, general sales tax accounts for 30.1% of total state tax revenue and selective sales tax (liquor, fuel, tobacco) totaled 16.3% in 2013. As such, state regulators try to collect every dollar that is owed to them. History certainly supports this claim since sale tax collections have steadily increased over the past 10 years. State regulators are now collecting nearly $400 billion in sales tax as compared to 2003 when states collected just over $250 billion. This growing trend is a consequence of complex regulations, new business models and technologies. Companies of all sizes need to have appropriate reporting processes in place to meet state sales tax regulations. To better understand these sales tax issues and the businesses that need expertise, we’ve analyzed our clients’ sales tax questions in this report.

Table 1

Our analysis

We analyzed over 2,200 client sales tax questions sent to our team of tax professionals over a 12 month period ending November 30, 2014. The clients varied by location, size, industry, tax personnel, and sales channel. Please note that most of the clients covered in the report were either small businesses (1-5 employees; <$1 million in revenue) or medium size (6-25 employees; $1 million to $25 million in revenue). Additionally, the type of sales tax questions varied by the following categories: tax compliance, tax nexus, product/service taxability, internet tax and use tax. We believe that our analysis is representative of the potential risk that could be triggered due to a failure of state sales tax compliance.

The survey

During the 2013 tax season, we surveyed over 3,500 users throughout the country that visited BIDaWIZ for tax help and/or to find a preparer to file their personal tax return. The respondents that were chosen at random, varied by income level, profession, age, geography, ethnicity and other demographic data. Thus, we believe that the survey results are representative of the general population that falls within the consumer tax category.

Location Matters

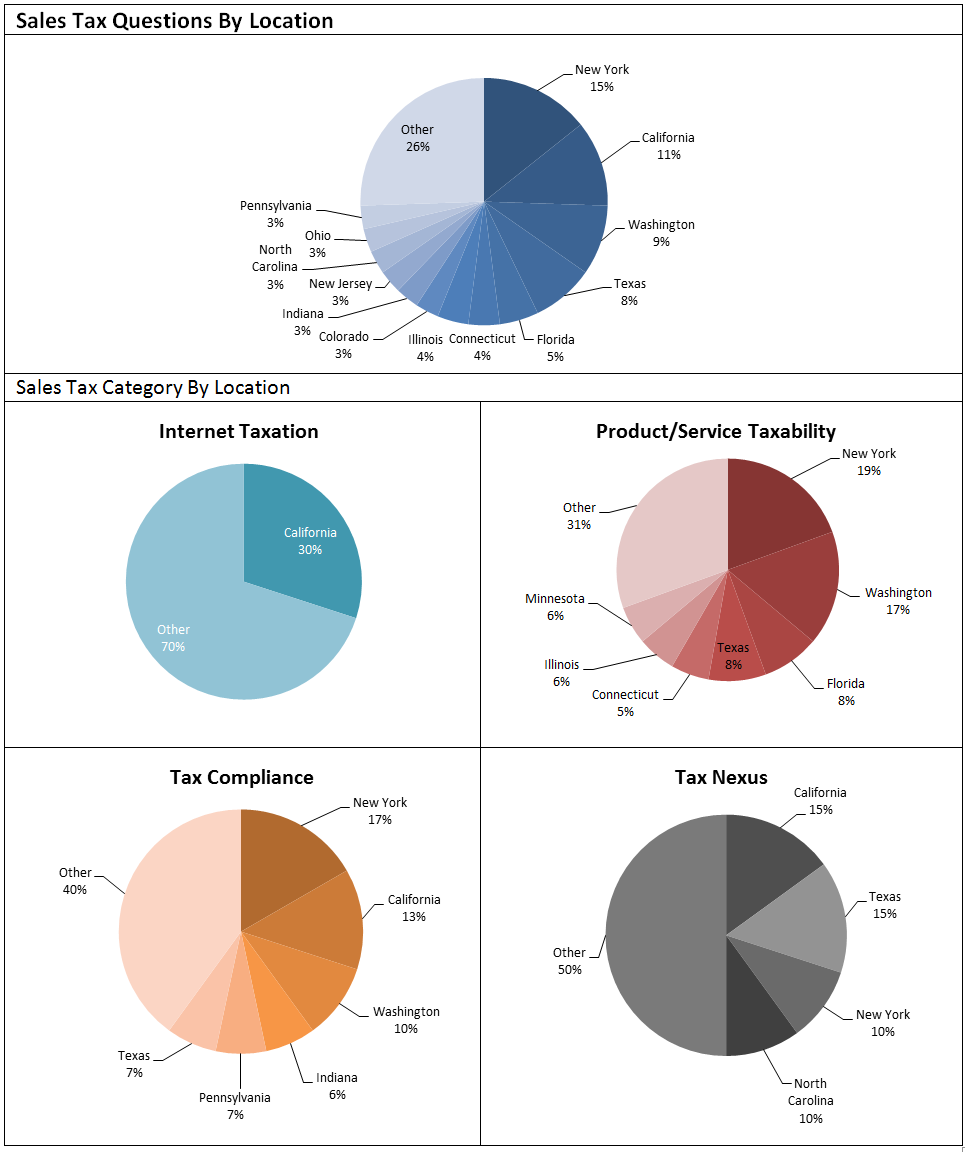

The data suggests that client questions were most relevant to businesses with a presence in New York, California, Washington, Texas & Florida, which all share common sales tax characteristics (Refer: Table 2: Sales Tax Questions By Location). Generally, many of these states have the highest sales tax rates in the country or in the top 25% quartile in comparison to the rest of the country. Furthermore, these states all have more than 50 different sales tax jurisdictions, which further increases the complexity associated with maintaining sales tax compliance within each of these states.

Internet Taxation, Product/Service Taxability, Tax Compliance & Tax Nexus By Location

The more granular data suggests that the type of sales tax questions varied by state. For instance, almost a third of clients with sales tax questions that related to internet taxation (online selling/buying) had a presence in California (Refer: Table 2: Sales Tax Category By Location). This is likely due to the fact that sales tax in general is more complicated for California sellers than in other states.

Product or service taxability was a major concern for Washington and New York based clients. The regulations for both of these states are complex as it pertains to whether or not certain products or services are taxable. In many instances, there are exceptions to the exceptions (i.e. digital goods/software).

Separately, New York, California & Washington had the most sales tax compliance related inquiries (Refer: Table 2: Sales Tax Category By Location). These types of questions covered exemption certificate management, frequency of remitting sales tax returns, and calculating the sales tax rates properly.

Tax nexus rules pose a greater risk to businesses with a presence in New York, California, Texas & North Carolina. Most of these states have widening sales tax nexus rules and they collect and have increased their sales tax collections for remote sellers. They have click-through and affiliate nexus.

Takeaway: Accountants and their clients need to be mindful of sales tax laws as it relates to each state. There are certain states such as California, New York, Texas & Washington that pose a greater challenge in sales tax compliance than other states in the country. Additionally, even if the business doesn’t have a physical presence in one of these states, they still may need to follow the laws of those jurisdictions.

Table 2

Who’s Asking Sales Tax Questions?

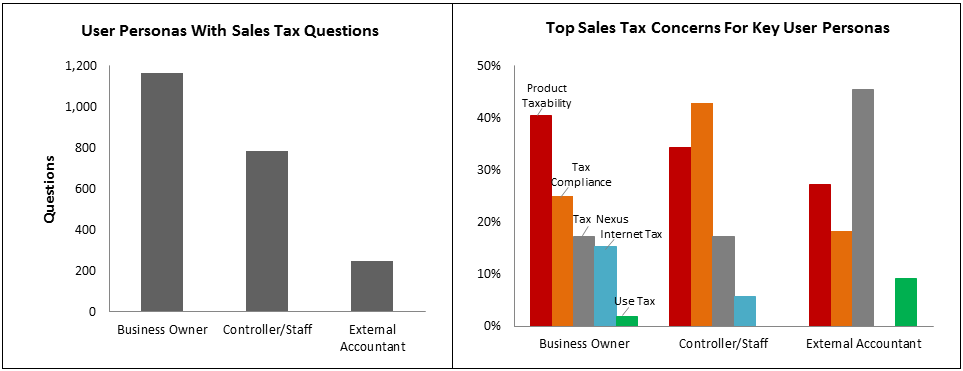

Of the 2,200 sales tax questions we analyzed, 1167 were submitted by business owners, 786 by the controllers/staff and 247 by an external accountant (Refer: Table 3: User Personas With Sales Tax Questions). We believe these figures not only illustrate the broad spectrum of user personas concerned with sales tax, but that it’s very important to business owners (Refer: Table 3: Top Sales Tax Concerns For Client Personnel). Interestingly, business owners are most concerned about product/service taxability rules and their questions were fairly high level and introductory (i.e. should we be collecting sales tax?). While most of the business owners covered in the report own a small to medium sized company, they did recognize the importance of having a sales tax compliance process in place.

As expected, controllers, tax directors, and staff accountants were most concerned about the sales tax remittance process, exemption certificate management & calculating the sales tax rate properly.

Nearly half of all external accountants asked questions about sales tax nexus. This is a high risk area for many practitioners who lack the sales tax knowledge across state lines. There were many instances in which the practitioner noted that their client is offering products or services either online or in another state. The other point to note is that only external accountants asked a meaningful number of use tax related questions. The logical question is how come they’re asking about use tax, but the businesses owners and controllers don’t seem too concerned? The answer may simply be that they don’t know enough to ask about use tax.

Takeaway: There is consensus within companies that sales tax compliance is an area of concern. Business owners are concerned about service/product taxability, controllers/staff are focused on tax compliance & certain external accountants need guidance on tax nexus. Lastly, use tax is a potential large risk area due to its lack of focus. Accountants and their clients need to focus more resources on addressing all of these areas of sales tax compliance. At the very least, they need to acknowledge their risk and put a plan in place to manage it.

Table 3

Sales Tax Questions Across Industries

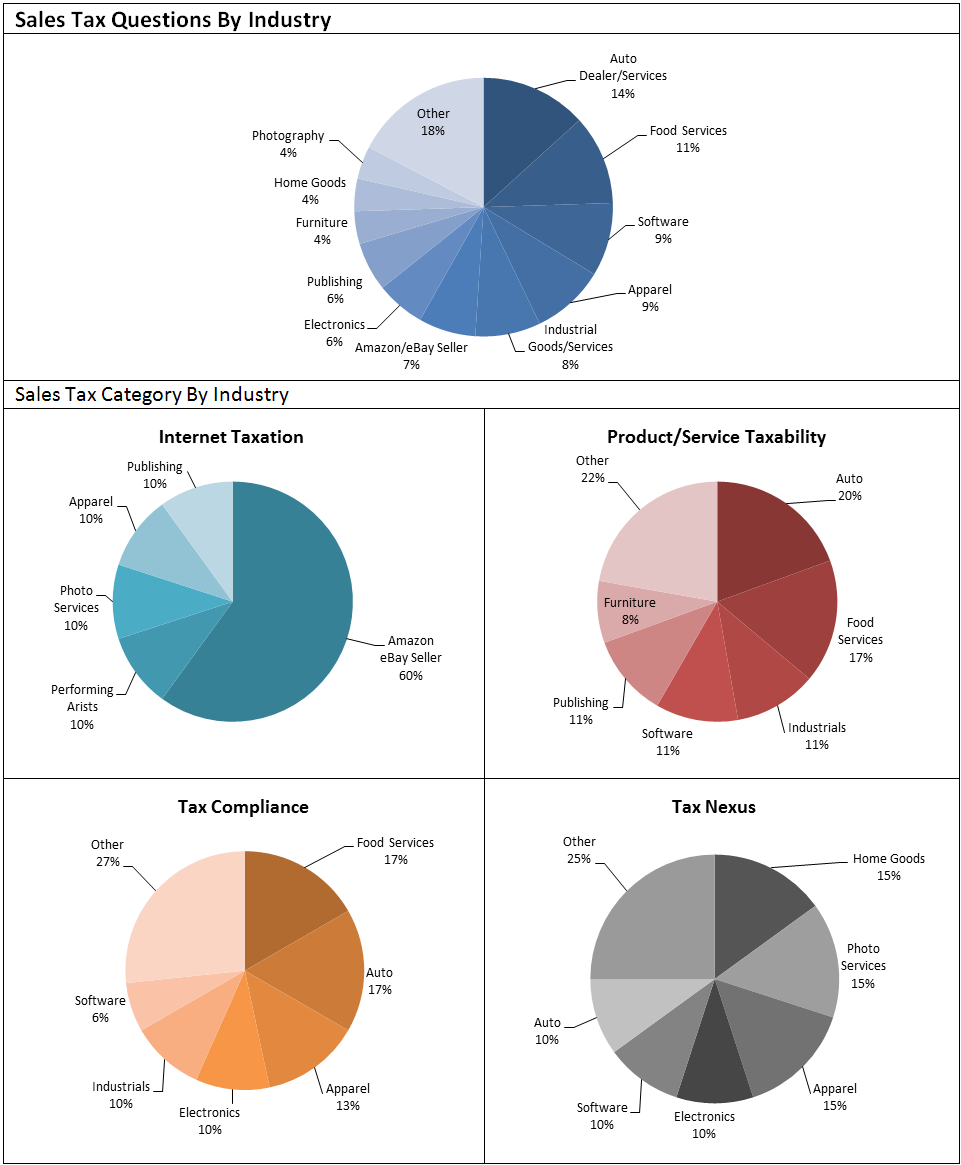

The majority of questions were in reference to clients in the following industries: auto dealerships and repair providers, restaurants and food service suppliers, software and development companies, apparel businesses, industrial goods/service providers and the online sellers such as Amazon & eBay (Refer: Table 4: Sales Tax Questions by Industry). All of these industry groups share certain characteristics in having a large variety of products, services, customers, locations and sales channels.

Not surprisingly, online sellers (Amazon & eBay) had the most internet related sales tax questions. The context of most of their inquiries as least in part were in reference to the Fulfillment by Amazon (FBA) program and selling through to clients located in other states.

Auto dealers and repair shops expressed frustrations over sales tax laws relevant to product/service taxability. Specifically, many of the clients were confused over the taxability of certain repair services within their state. Food service suppliers and retail restaurants accounted for a large portion of taxability related inquiries. For instance, there was lack of clarity over the sales tax rules for serving food in restaurants versus in a pre-packaged form (Refer: Table 4: Sales Tax Category by Industry).

Food service businesses, auto dealerships and apparel companies all inquired about sales tax remittance, exemption certificate management & rate calculation.

Tax nexus rules were important to all companies. However, many of the e-commerce businesses in the home goods, photo services and apparel industries needed assistance with understanding state sales tax laws.

Takeaway: Sales tax compliance risks impact many industries. However, the following industries are impacted greatly: auto dealerships and repair providers, restaurants and food service suppliers, software and development companies, apparel businesses, industrial goods/service providers and the online sellers. Furthermore, many of the companies within the sample share certain characteristics. Namely, they had multiple locations, sold online, had a diverse client-base and had a variety of goods/services. Accountants need to identify clients with the aforementioned sales tax risk profiles and put a plan/recommendation in place to alleviate those concerns.

Table 4

What should clients do to better manage sales tax compliance?

First, clients need to identify their risks by analyzing product/service taxability exposure, nexus presence, customer composition, physical footprint and internal sales tax compliance processes. Then, they should incorporate automated technologies where applicable to mitigate their compliance risks as well as seek outside sales tax expertise.

What do we recommend for practitioners?

Professionals should assess their clients’ businesses in analyzing the key risk profiles. In those instances in which the practitioner does not have sales tax expertise, he/she should consider partnering with an accountant or firm that can fill that void. In addition, there are many sales tax compliance solution providers in the marketplace that the practitioner can introduce to their clients to assist in sales tax compliance.

More questions? Browse answers or ask sales tax questions online.

Related Articles

->Will There Ever Be An Internet Sales Tax?

->Your Business May Be Subject To Trailing Sales Tax Nexus

->Is Your Business Subject To Sales Tax In Other States?

->The Best Sales Tax Software Solutions Webinar

->How Sales Tax Changes Hurt One Small Business

->Is Your Business At Risk For A Sales Tax Audit?

->Benefit From The 2014 Sales Tax Holiday Season

->Are Sales Tax Holidays Good For Business?

->Online Shoppers May Have To Pay A Use Tax Soon

Tags: sales tax questions, tax nexus questions, business tax questions