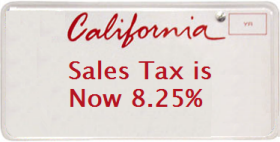

Despite desperate calls from small business advocacy groups to implement fiscal policies that spur economic growth, California maintains the highest state sales tax rate in the country. A whopping 8.25%. To refresh your memory, California recently (4/1/09) increased the state sales tax by 1% to compensate for the massive budget crisis. The good news is that the 1% “temporary” increase is set to expire on June 30, 2011. But, with all of these sales tax changes, how should small businesses prepare their books?

Preparing the Books

Preparing the Books

The first step is to run a few tests incorporating the sales tax change. Be sure to test your point of sale applications and bookkeeping software during downtime. This will provide some insight into potential problems that may occur when the change goes into effect.

Recording Sales Tax Properly

Many businesses mistakenly forget to 1) record sales tax properly & 2) deduct the amount from the total sales. As a reminder, California sales tax is not part of gross revenue rather it is a tax the business collects for the state taxing authority (i.e. the BOE or the Board of Equalization). For instance, a business that sells books to a customer for $100, would collect $108.25 ($100+$8.25 in sales tax) and record only $100 in revenue & $8.25 in sales tax liability. When the business pays that taxing authority, sales tax liability would decrease by $8.25 and cash would decrease by the same amount.

What If I Sell Online?

When selling goods or services online, make sure you are including the appropriate sales tax in the final cost. The general rule of thumb is that an Internet seller must collect sales from the buyer if the seller has “tax nexus” or a substantial presence with the buyer’s state.

What is Tax Nexus?

Tax nexus is equivalent to having a physical presence (business location, resident employees, intangible or tangible property) in a particular state. As you might imagine, whether a seller has nexus is not always an easy determination (and NY has a new law that would expand what constitutes nexus – although the law is still being challenged by Amazon.com through an appeal).

More Sales Tax Questions?

Related Articles

->Where Is My California State Tax Refund?

->1099 Form Filing Requirements For 2012

->How Do I Treat a Discount For Bookkeeping Purposes?

->Should I Withhold Taxes From Employee Checks?

->Discounted Loan Rates For Businesses That Are Hiring?

->Are Vehicle Start-up Costs Tax Deductible?

->Employer 1099 and W2 Form Tax Questions