This week the Tax Policy Center issued a report detailing the number of filers that don’t pay any taxes. The figures have changed since the recession of 2008, but the numbers may still surprise you.

70 Million Homes Can Expect To Pay No Taxes In 2013

70 Million Homes Can Expect To Pay No Taxes In 2013

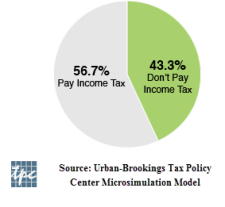

Despite much of the political rhetoric in Washington, lower income earners in the US still pay no taxes due to various tax exclusions, deductions, credits and exemptions. In fact, 43.3% of all households aren’t expected to pay any taxes for the calendar 2013 year. There’s a catch though, of the 43.3% of households that don’t pay tax, 28.9% pay payroll taxes for Social Security of 6.2% and Medicare of 1.45%. That leaves 14.4% of household paying no tax at all. If you’re wondering, about 70% of the 14.4% that pay no tax are the elderly.

Does adjusted gross income matter?

The zero tax figure is actually not evenly distributed among income groups. However, as you might expect those that earn less than $30,000 annually represent the largest percentage of filers that don’t pay any taxes or 67%. However, some high income earners don’t pay any taxes at all. Almost 850,000 households earning between $100,000 and $500,000 don’t pay any tax and the same applies to the 3,000 filers that earn over $500,000. Lastly, 1,000 filers earning over a million, avoid taxes as well. You’re probably wondering how could this be the case with tax rates at 43.4%. Many of these high-income earning filers utilize advantageous charitable deductions to lower their taxable income. This isn’t all bad for the country. While the income isn’t going directly to the federal government, it still is intended to benefit social causes.

More Tax Questions? Browse Answers or ask your tax questions online.

Related Articles

->What Should I Do If I Can’t File My Taxes In Time?

->Avoid These Common Tax Return Mistakes

->Choosing The Right Accountant For An IRS Issue

->Ways To Mitigate 2013 Taxes On Estates And Trusts

->What Should I Know to Avoid the Alternative Minimum Tax?